Last fall, Alex and I discussed bringing back the TC+ robotics survey. I gave him the usual caveat: I’m into it, but it will have to wait until I can find the time. You know how these things go — you wake up one morning and somehow it’s five months later. I’ve got excuses if you need them.

I got burned out and took a few weeks off in December. And then it was CES and MWC, and suddenly I’m back at 2019 travel levels, wondering if my rabbit will remember my name when I walk through that door.

So if the survey wasn’t overdue before, it unquestionably is now. The last time we ran one of these was back in February 2020 — ominous timing, to put it mildly. The world had entered the earliest stages of the COVID-19 pandemic, and following the first waves in Asia and Europe, the U.S. was right on the cusp of getting hit hard.

It was, in hindsight, the beginning of a seismic shift for many industries — and robotics was primed to help. In fact, one can make a compelling argument that those three intervening years were the most broadly transformative for the category. It was a perfect storm. Growth on the warehouse/logistics side had its own sea-change moment eight years prior, with Amazon’s Kiva acquisition.

Retailers that were behind the curve had two choices once the pandemic rolled around: automate or die. It’s a stark framing, I recognize, but remember that anyone not classified an “essential worker” was suddenly grounded. Overnight, companies were attempting to compete with Amazon’s promise of same- and next-day shipping with far fewer people. It’s frankly a wonder that so many came out the other side intact.

Other industries were desperate to follow fulfillment’s lead. Suddenly, it seemed, a lot more money was flooding in to robotic solutions to categories like construction, agriculture, food service and healthcare, to name a few. Thankfully, robotics had seen profound advances in the previous decade, owing to advances in other fields like consumer electronics (sensors) and self-driving cars (sensors).

In fact, I don’t think I would get much pushback for saying that robotics has thus far benefited more from autonomous driving advances than the cars themselves. I’m not saying that will always be the case, but there are myriad reasons why it’s far easier to operate a warehouse robot autonomously than it is to automate a 4,000-pound car cruising down a highway at 65 mph.

Following this all in real-time, I will say, anecdotally, that the excitement surrounding robotics shielded it from the effect of early macro trends. There was a little while in which investments in the space kept chugging along, but I don’t think any of us expected that to last forever. Ultimately the bad economy slowed things down, and a couple of bank collapses certainly didn’t help matters much.

I continue to be extremely bullish, however. And I’m certainly not alone in that. External forces were bound to hamper investments for a bit, but it never felt like a regression. In fact, it didn’t feel like the pandemic expanded the industry as much as it accelerated it by a few years. Everything that’s happening right now has felt inevitable for a while, but it’s always been a question of when.

As you can no doubt imagine, I have a lot of questions after three years. The good news is I was able to whittle them down to a mere nine. I sent out a survey to top investors covering topics ranging from the state of investing, to RaaS, to what automation can do to address climate change. In the end, we had 13 investors send back responses. The answers were thoughtful and candid and — taken as a whole — provide what may well be the best snapshot of this moment in robot VC.

Image Credits: Bryce Durbin/TechCrunch

The list includes:

Milo Werner, general partner, The Engine

Abe Murray, managing partner, Alley Robotics Ventures

Neel Mehta, venture investor, G2 Ventures

Oliver Keown, managing director, Intuitive Ventures

Rohit Sharma, partner, True Ventures

Helen Grenier, adviser, Cybernetix Ventuers

Kira Noodleman, partner, Bee Ventures

Peter Barrett, general partner, Playground Global

Kelly Chen, partner, DCVC

Danya Grayson, co-founder and general partner, Construct Capital

Paul Willard, partner, Grep

Cyril Ebersweiler, general partner, SOSV

You can check out the survey over on our premium service, TechCrunch+. As you can imagine, we got a lot of answers. The good news is that this will really help me write Actuator for the next few weeks.

I will be highlighting a few questions — and corresponding answers — here, starting today.

TC: What is the next big robotics success story after warehouse/fulfillment?

Milo Werner, The Engine: Basically everything around you will become a robot. The most simple example is autonomous vehicles. These are very advanced robots and have been open to riders since 2018. The labor shortages are going to drive significant growth in the service sectors, including cleaning, food and care services. While there are already automated single-purpose solutions in these areas, more general-purpose robots are going to start to take front stage in the next decade.

Neel Mehta, G2 Venture Partners: I’d say it’s either going to be food or manufacturing. Food: We are seeing restaurants, co-packers, and frozen meal manufacturers increasingly gravitate toward robots. I’m specifically talking about high-mix production, whereby food production is more complex with lots of ingredients and SKUs (automation is already common in low-mix production). We’ve heard that the food industry is 40% understaffed and operating at less than 50% capacity. Working conditions are also poor and worker performance is inconsistent (resulting in waste). It’s still early days for this space, but there are a handful of interesting companies deploying robots at frozen food manufacturers and restaurants (e.g., Miso Robotics, Chef Robotics, Hyphen) Manufacturing: On-shoring of manufacturing due to IRA-related tailwinds is going to have a massive impact on deployment of robotics in the next five to 10 years. There is a growing skills mismatch that will result in millions of unfulfilled manufacturing jobs in the latter part of the decade. Welding is particularly interesting because of the aging population of human welders.

What categories are the most underserved by robotics startups? What would you like to see more of?

Abe Murray, Alley Robotics: All of them! We believe there should be 10x more robotics startups than there are today. There are gaps and opportunities everywhere. Even in logistics, the most saturated space in robotics, fewer than 10% of warehouses are automated.

Oliver Keown, Intuitive Ventures: Automation and miniaturization in healthcare. Integration of the robot and biological manipulation. To take minimally invasive care to the next level, there needs to be technology that enables treatment to the right patient at the right time at the site of disease — from immunotherapy to gene and cell therapy, to novel energy modalities.

More next week!

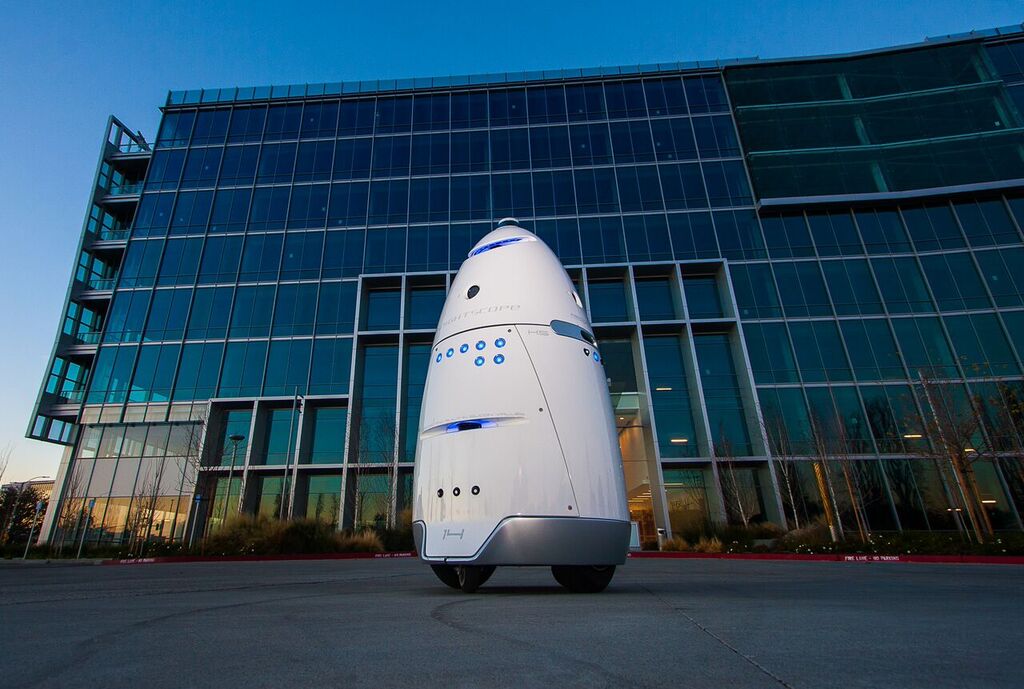

Image Credits: Knightscope

Sometimes you’re uniquely qualified to write a story — but that’s not necessarily a good thing. Since I’m a longtime New York resident who writes about robots for a living, Mayor Eric Adams’ recent press conference was right in my wheelhouse. The city is now piloting two surveillance robots in high-traffic areas: Boston Dynamics’ Spot (referred to as “Digidog” here) and Knightscope’s K5.

“I’ve stated this from day one, even when I was on the campaign trail: I’m a computer geek. I believe that technology is here,” Adams noted in his remarks. “We can’t be afraid of it, and as [NYPD commissioner Keechant Sewell] stated, transparency is the key.” Asked about the de Blasio administration’s decision to pull Spot pilots over public backlash, Adams stated, “Digidog is now out of the pound.”

Image Credits: Carbon Robotics

This week, Carbon Robotics announced a $30 million raise to help scale its laser weeding robot, LaserWeeder. The Seattle-based firm says that it has zapped “500 million weeds across 40 different crops” thus far. No specific unit figures, but Carbon is set to deliver LaserWeeder to 17 U.S. states and three Canadian provinces in 2023.

“This financing round further supports our mission to provide cost-effective and efficient precision agtech tools to growers,” founder and CEO Paul Mikesell said of the Series C. “Traditional weeding methods, including hand weeding and herbicides, are expensive, unreliable and damage soil health. The LaserWeeder uniquely addresses all of these challenges.”

Image Credits: Amazon

Also this week, Amazon announced the publication of a pick and place dataset featuring more than 190,000 objects. The company notes:

The scenario in which the ARMBench images were collected involves a robotic arm that must retrieve a single item from a bin full of items and transfer it to a tray on a conveyor belt. The variety of objects and their configurations and interactions in the context of the robotic system make this a uniquely challenging task.

Jobs

Trying a new approach to job listings. I’m including a Google form. Same rules as always. Robotics companies only (openings don’t have to be for roboticists). I have no idea why I got so many 3D-printing companies this week…To be included, enter the company’s name and the number of open roles/positions. Companies not included in the previous list get priority. This form will stop accepting new submissions on Monday, April 17. Godspeed.

Robot Jobs for Human People

Ambi Robotics (5 roles)

Bitcraze AB (1 role)

Formic (11 roles)

Halo.car (1 role)

ISEE (34 roles)

Jacobi Robotics (1 role)

Kiwibot (30 roles)

Roboto AI (2 roles)

Image Credits: Bryce Durbin/TechCrunch

Back at next week. Meantime, subscribe if you haven’t already (you know who you are).