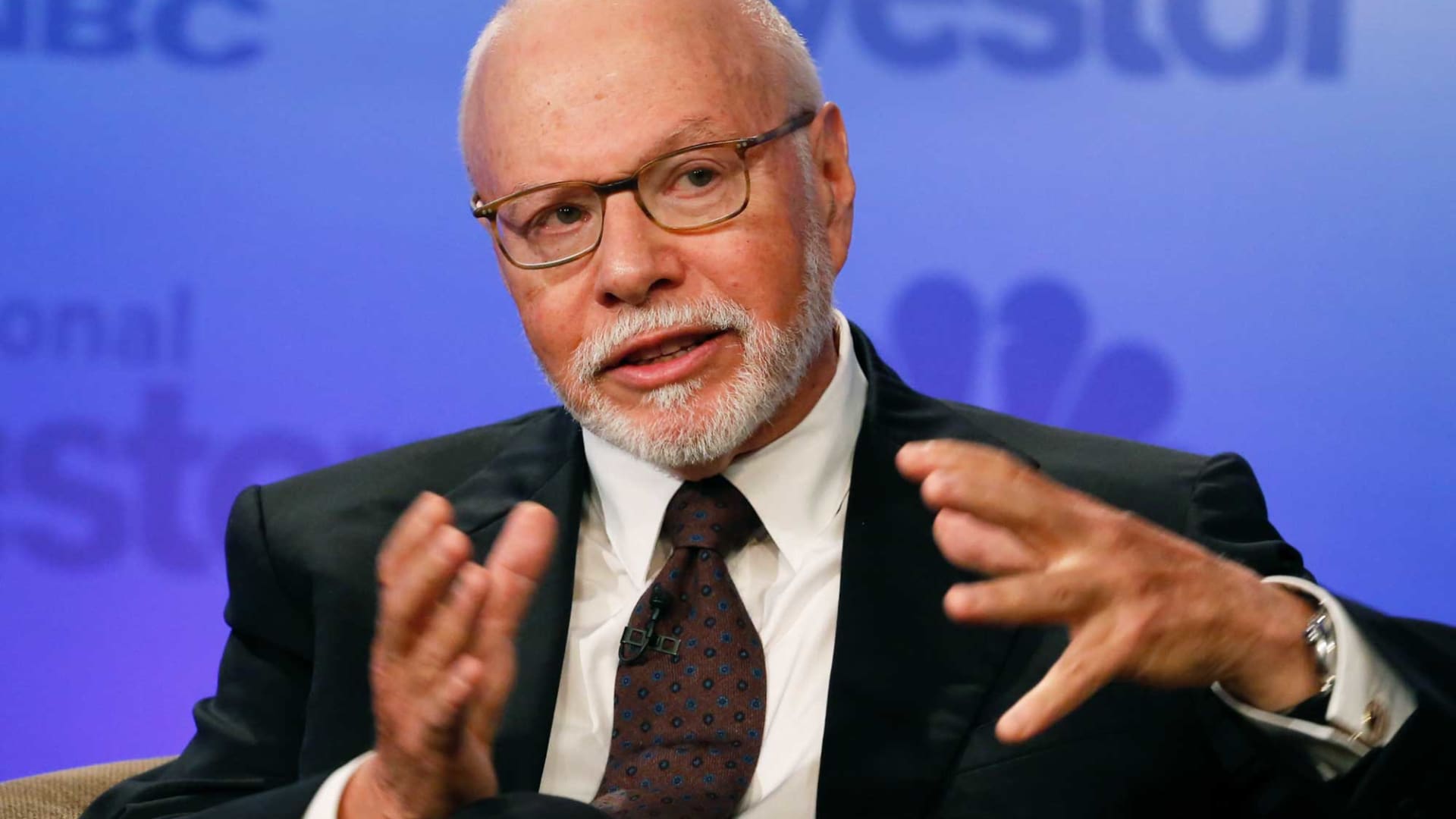

Activist investor Elliott Management unveiled a new stake in a little-known independent music stock during the first quarter, according to recent securities filings. The Florida-based hedge fund founded by billionaire Paul Singer in 1977, bought about 402,000 shares of Reservoir Media totaling $2.6 million during the period as he liquidated his position in News Corp . Meanwhile, Singer hiked his stake in Triple Flag Precious Metals — his second-largest holding — by 3.6% to a little over $2 billion. The prominent investor also opened a call option on the Invesco QQQ Trust totaling about $2.6 billion and a put equaling $300.9 million. As the energy sector slumped, Singer maintained his $1.49 billion stake in Marathon Petroleum , and positions in Noble Corporation and Suncor Energy . Singer reduced his bet on Peabody Energy by 8.3%. Elliott also liquidated its nearly $47.5 million stake in Aerojet Rocketdyne . On the technology front, Singer maintained his $761.2 million stake in Pinterest , and smaller positions in PayPal and Western Digital . Recent filings show that Elliott, among the largest hedge funds in the world, managed roughly $93.2 billion regulatory assets.