When the global pandemic hit, independent restaurants and shops that didn’t already have an online ordering system in place found themselves scrambling to keep operations going when consumers no longer were going into establishments.

That’s where Odeko has come in, providing supply chain management and other operations tools to independent coffee shops and cafés. That includes smart operations software to help customers manage inventory, get data insights and order equipment and supplies from more than 400 vendors in a way that is less expensive and reduces their environmental footprint.

“It’s been a rough number of years for hospitality, generally,” Odeko CEO Dane Atkinson told TechCrunch. “We’ve gone through a pretty rough supply chain crisis. A lot of our focus was making sure they could have cups and lids that matched and getting them cheaper prices so they spend less on that cup every day considering that milk, eggs and everything else has consistently jacked up their costs.”

Today the company, founded in 2019 by Atkinson, works with 10,000 small businesses and is experiencing revenue growth of over 300% year over year. He said Odeko is able to save customers up to 21% on the cost of goods and up to 10 hours a week of time spent on managing vendors.

It is in 16 markets locally, and in the past year, expanded into six of those, including Miami, Portland and Dallas. It is also available in the rest of the United States through e-commerce and other solutions.

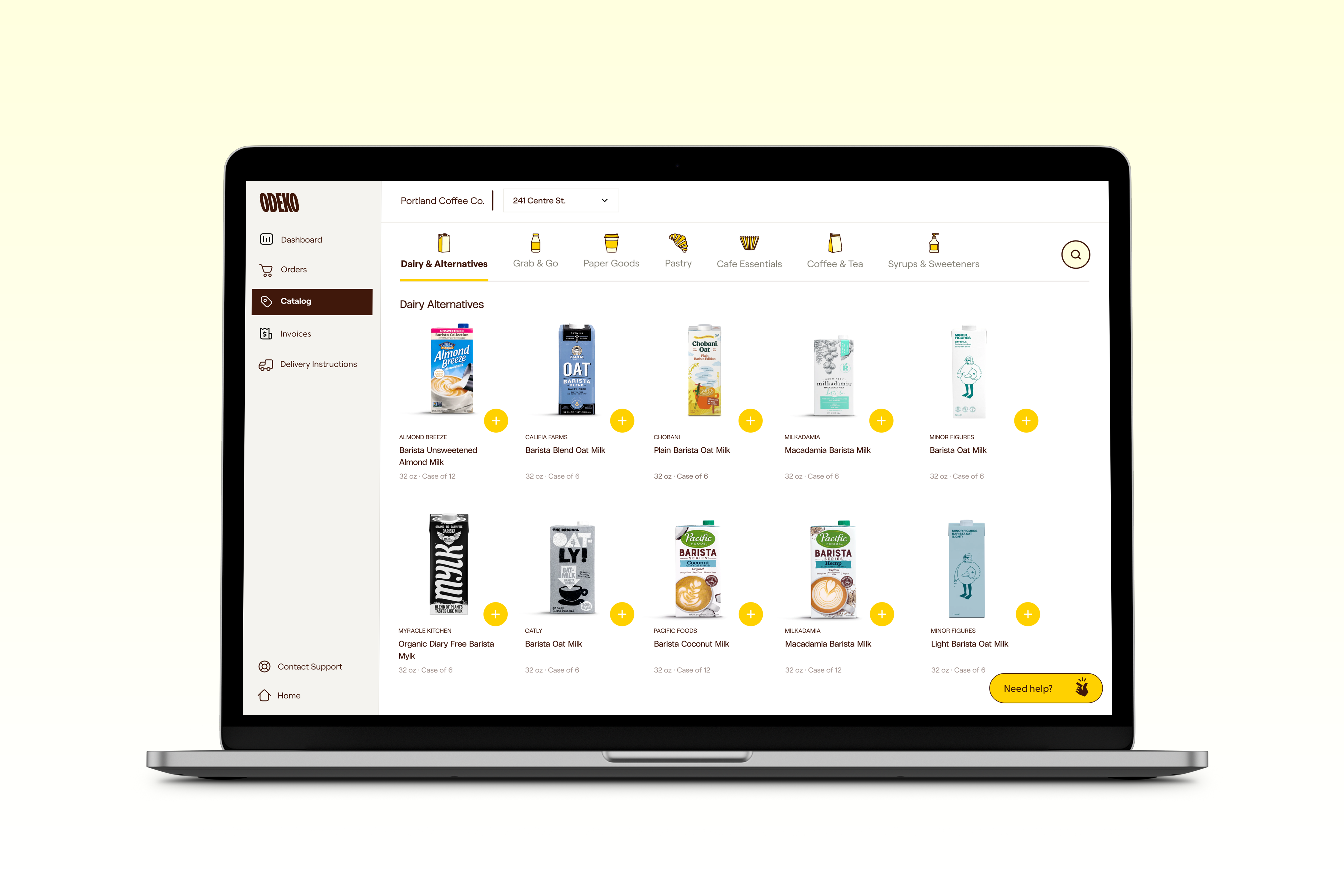

Odeko’s dashboard. Image Credits: Odeko

Odeko recently raised $53 million in Series D financing to bring its total equity investment to date to $177 million, which includes a $12 million Series A in 2020. The round was led by existing investor B Capital and includes existing investors GGV Capital and Tiger Global Management, and new investors, including Amex Ventures, KSV Global and FJ Labs.

Though Atkinson would not get specific, he did say that the company’s valuation was 25% higher than Odeko’s previous round of $77 million in Series C capital announced in 2022, according to Crunchbase data.

Atkinson intends to deploy the new capital into technology development, scaling its operations and entering new markets.

“This past year was the kind of climate that proved our model worked really well,” Atkinson said. “We now have built a really good foundation underneath this, with quite a bit of capital, and now we’ll expand back into growth and add new markets and new adjacencies toward the latter half of this year. We’re sensitive to the market we’re in, but we are putting additional capital to work to take the formula and run it in other places.”

If you have a juicy tip or lead about happenings in the venture world, you can reach Christine Hall at chall.techcrunch@gmail.com or Signal at 832-862-1051. Anonymity requests will be respected.