Retention isn’t a silver bullet, but in SaaS, it’s the closest thing to it.

High retention indicates strong product-market fit. It is proof that you are solving a real problem and are adding value to your customers.

High retention also means better growth. Companies with best-in-class retention grow at least 1.5x-3x faster.

Finally, high retention means a more capital-efficient business. In SaaS, acquiring customers is the most costly part of running your business. Even at scale, sales and marketing expenses make up the majority of your expenditure. If you are unable to retain these expensive-to-get customers, your business is going to be less efficient and cost more to scale.

It’s no surprise, given all this, that companies with higher net revenue retention often command higher valuations.

How can companies know if their retention rate is up to par? And with the recent market downturn, is retention lower than it used to be?

There’s no better way to answer that than to look at real data. At ChartMogul, we studied more than 2,100 SaaS businesses to bring retention benchmarks and trends to the SaaS community. Here are our key takeaways.

Retention in 2022 was harder than ever

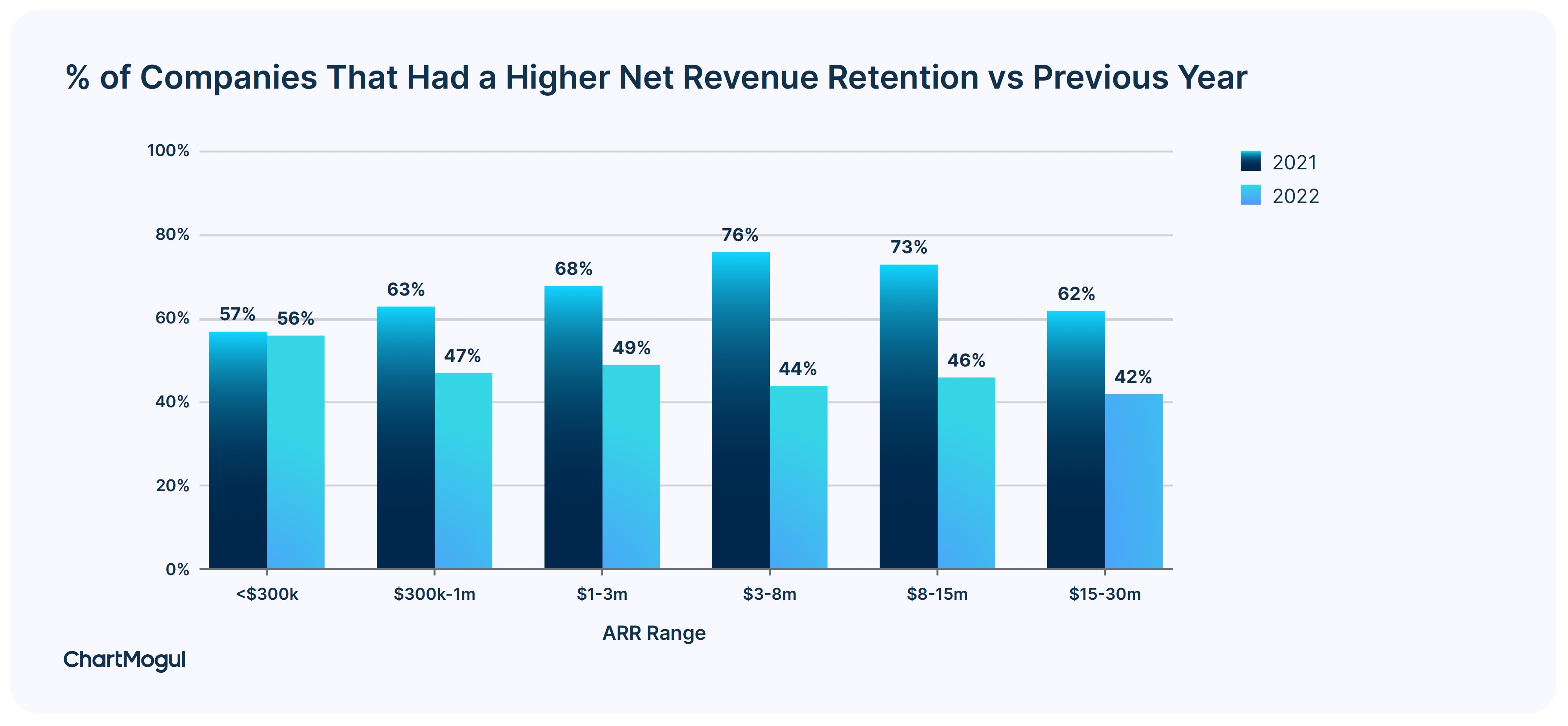

More than half of SaaS businesses had lower retention in 2022 when compared to 2021. A challenging macroeconomic environment meant subscribers reassessed and cut their SaaS spend. This is in sharp contrast to 2021, which saw almost 70% of businesses having a higher retention rate in 2021 when compared to 2020.

Percentage of companies that had a higher net revenue retention vs. previous year. Image Credits: ChartMogul

This trend of retention being lower in 2022 vs. 2021 is not unique to SaaS startups. SaaS behemoths like Snowflake also saw their retention come down from the highs of 2021.

SaaS businesses over $3m in ARR should target a net retention rate of over 100%

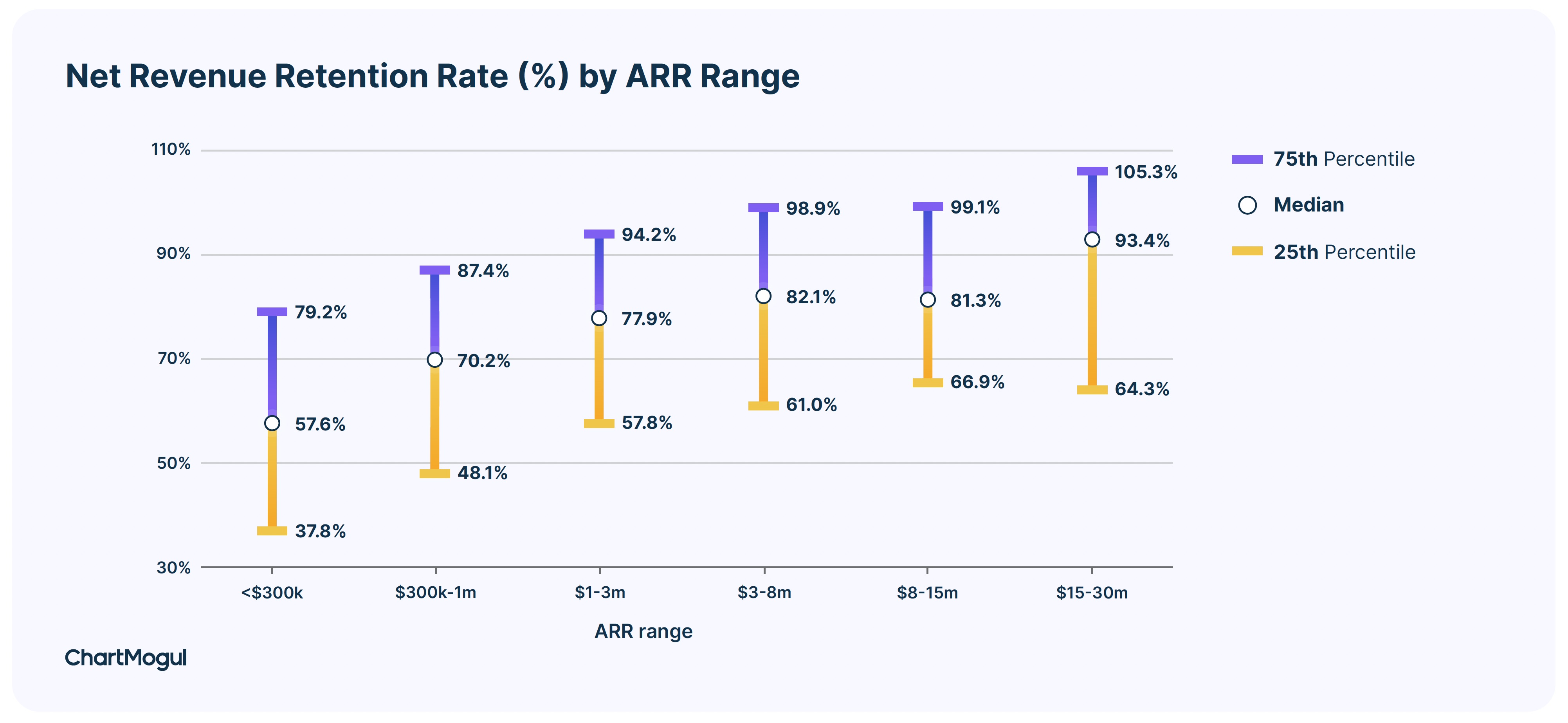

What is considered a good net retention rate differs by the stage of your business.

In the pre-product-market-fit stage of the business, net retention is usually poor. As startups grow and find product-market fit, net retention improves. Finally, as companies reach scale and become category leaders, net retention often goes over 100%.

When benchmarking, always keep the stage of your business in mind. Businesses with ARR in the range of $1 million-$3 million have a top quartile net retention rate of 94%. Those in the $3 million-$15 million ARR segment have a top quartile net retention rate of 99%. Businesses at scale with ARR in the range of $15 million-$30 million have a top quartile net retention rate of over 105%.

Net revenue retention rate (%) by ARR range. Image Credits: ChartMogul

A net retention rate of less than 100% means that your ARR decays, which means that you have less ARR today than a year ago from the same set of customers. A net retention rate of over 100% indicates strong product-market fit and showcases your ability to compound your revenue from your existing customer base.

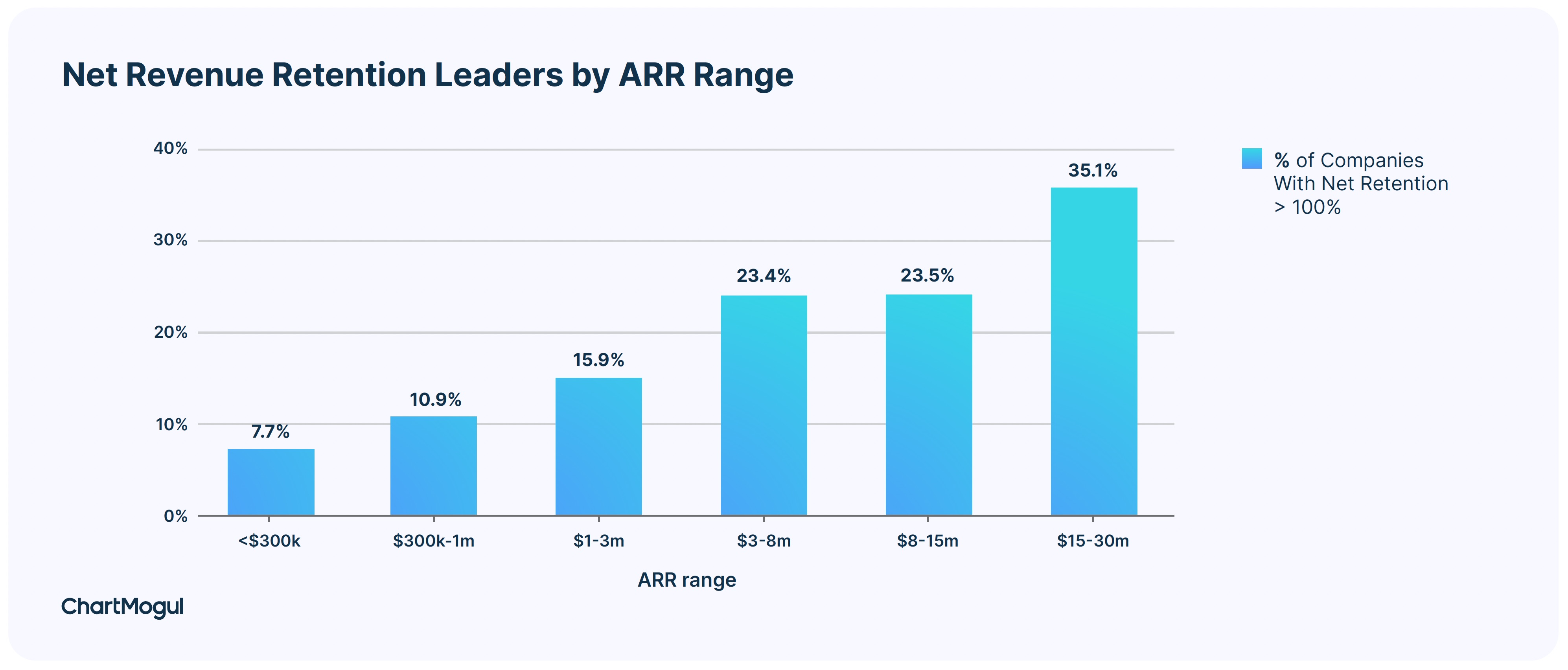

Amongst higher ARR ranges, more businesses have a net retention rate over 100%. Just over 35% of SaaS businesses in the $15 million-$30 million ARR range have a net retention rate of over 100%.

Net revenue retention leaders by ARR range. Image Credits: ChartMogul